Posted on 29th Jul 2020

#premium #subscription #walkthrough #education

What's up LSS readers, we hope you've had a stellar start to the week?

Recently, we've received a lot of interest in our premium subscription and similarly, there have been many questions as to what the subscription includes by way of signals, services, functionality, etc....

Therefore, we have decided to put together a 'walkthrough' video which acts as a sneak preview of all the exclusive content available to premium subscribers.

Should you be interested, please check out the video here.... Read More

Posted on 24th Jul 2020

#market structure #Cryptocurrencies #correlation #market views #weekend thoughts

I make it a habit to study both the micro structure and the macro structure of the market. What I mean by that is that I may spend a lot of time looking through correlation matrices, studying market structure and broader patterns over longer term data, but despite not really being much of a day trader I also find myself glued to Bloomberg screens daily to watch the minute and second ticks of a large number of asset classes. The reason I do that is that I believe often the micro charts provide information about market changes that are going to go on to become longer term trends.... Read More

I make it a habit to study both the micro structure and the macro structure of the market. What I mean by that is that I may spend a lot of time looking through correlation matrices, studying market structure and broader patterns over longer term data, but despite not really being much of a day trader I also find myself glued to Bloomberg screens daily to watch the minute and second ticks of a large number of asset classes. The reason I do that is that I believe often the micro charts provide information about market changes that are going to go on to become longer term trends.... Read More

Posted on 18th Jul 2020

#signals #market views

What's up LSS readers, hope you are all enjoying your weekend. We sure have, as a bit of normality seems to be returning to life in the crazy new COVID-19 world we are all facing. Today we want to share with you an exclusive snapshot of the latest signals we make available to our Premium subscribers. If you sign up for a premium account you can get these delivered straight to your mailbox as and when they get triggered but as a one off we would like to make our calls available to a broader public today.... Read More

Posted on 14th Jul 2020

#Cryptocurrencies #stocks #correlation

The easiest way to monitor how these two assets co-behave is through studying asset class correlations. The correlation between Bitcoin and the S&P500 over the last 3 months stands at 0.11. Meanwhile if we look at the same number towards the end of June 2020, it read 0.26. So correlations have been high but they have also been falling. In this Views piece we go into a bit of the recent history of the correlation between stocks, volatility and Bitcoin.

... Read More

Posted on 11th Jul 2020

#model portfolio #performance

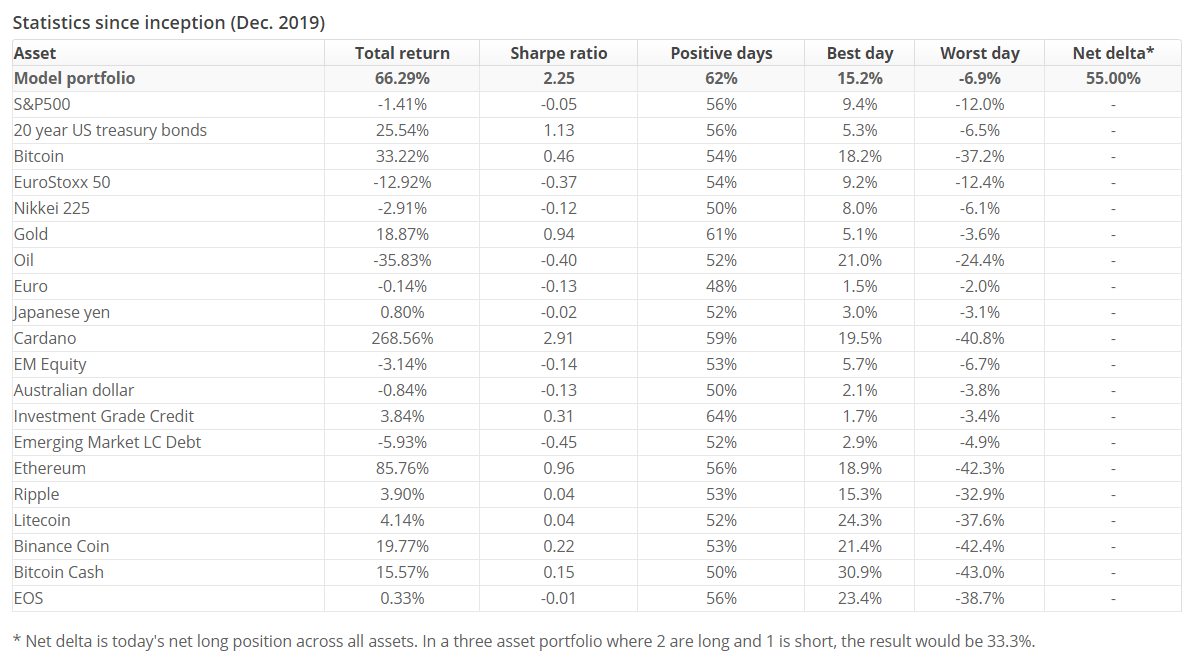

Just leaving this here.. a snapshot of our model portfolio performance thus far in 2020. Here at LongShortSignal.com we provide day to day quantitative trading signals on (as of writing) 25 assets, which on average have had a 72% win rate (with the winners gaining 23% on average and the losers losing 6%). However, the real strength of our approach shines through in our model portfolios which are up +66% (crypto and traditional), +28% (traditional only) or +237% (crypto only) on year-to-date basis.... Read More

Just leaving this here.. a snapshot of our model portfolio performance thus far in 2020. Here at LongShortSignal.com we provide day to day quantitative trading signals on (as of writing) 25 assets, which on average have had a 72% win rate (with the winners gaining 23% on average and the losers losing 6%). However, the real strength of our approach shines through in our model portfolios which are up +66% (crypto and traditional), +28% (traditional only) or +237% (crypto only) on year-to-date basis.... Read More

Posted on 5th Jul 2020

#model portfolio #models #signals

Our premium and crypto subscribers get access to the full range of LSS (crypto) signals, which they can use to their own benefit in their own investment processes. In addition they get access to our flagship model portfolios for both traditional/crypto and pure crypto assets. This is the product where all of our best ideas come together and we wanted to highlight some of the recent risk/return characteristics and the benefits of following along with our trading signals here.... Read More

Posted on 2nd Jul 2020

#market views #stocks #diversification

One of the more interesting things I've observed in the markets over recent years is that while there has undoubtedly been inter-asset class integration (meaning during periods of turmoil correlations tend to 1 between stocks, bonds, real estate, commodities etcetera), we have actually observed intra-asset class divergence in many places. Or to put it in a more quantitative way: the correlation of for instance Netflix and Amazon with the S&P500 was lower than that of emerging market stocks and real estate to the S&P500 during the worst of the 2020 sell-off.... Read More

Posted on 28th Jun 2020

#signals #investment process #model portfolio

I wanted to share a quick few thoughts with you about using our signals in your investment process, and what to expect in terms of win rates. Are we at LongShortSignal actually able to predict the market, if so why is no one else doing it and exactly how game-changing is our output? Those are a few of the things I will go into in this very short piece. For starters, it is my firm belief that markets are inherently unpredictable to an extent and there's no magic potion that will allow anyone to predict how assets will behave today, tomorrow or a week from now. ... Read More

I wanted to share a quick few thoughts with you about using our signals in your investment process, and what to expect in terms of win rates. Are we at LongShortSignal actually able to predict the market, if so why is no one else doing it and exactly how game-changing is our output? Those are a few of the things I will go into in this very short piece. For starters, it is my firm belief that markets are inherently unpredictable to an extent and there's no magic potion that will allow anyone to predict how assets will behave today, tomorrow or a week from now. ... Read More

Posted on 27th Jun 2020

#investment process #diversification #market views

So far, 2020 has been nothing if not a wild ride for financial markets. The S&P500 started the year on a slow upwards grind and was up as much as 5% by February (which would have been a respectable result for the entire year if it had only stayed there). It then started dumping to the bottom from 19th February onwards, eventually going as far down as -30%. We all know what happened next as central banks stepped in to save the day, one after the other. Today, it would appear to me that markets remain fragile as risk levels remain elevated and concerns about things like global economic growth and the impact of COVID-19 but also geopolitics, trade friction, upcoming US elections etc. continue to weigh on sentiment.... Read More

Posted on 26th Jun 2020

#Cryptocurrencies #models

We are happy to announce that as of today we have expanded our premium model offering to include no fewer than 7 cryptocurrencies. Included in our signal coverage from today on are: Cardano, Ripple, Ethereum, Litecoin, Binance Coin, Bitcoin Cash and of course Bitcoin itself. And while generally, we will reserve our premium signals for premium users, on this special occasion we can let you know that all of them except for Bitcoin have incepted with a LONG signal.... Read More

We are happy to announce that as of today we have expanded our premium model offering to include no fewer than 7 cryptocurrencies. Included in our signal coverage from today on are: Cardano, Ripple, Ethereum, Litecoin, Binance Coin, Bitcoin Cash and of course Bitcoin itself. And while generally, we will reserve our premium signals for premium users, on this special occasion we can let you know that all of them except for Bitcoin have incepted with a LONG signal.... Read More