Posted on 19th Jun 2020

#market views #weekend thoughts

As I sit out here in Asia watching my Bloomberg screens on a late Friday night / early Saturday morning I thought to share a few quick thoughts on the markets with you all. On my screen I see predictable headlines passing by about Ray Dalio warning that we may be looking at a "zero decade" for US stocks as profit margins reverse, JPMorgan discussing the highest ever levels in cross-asset correlation and another warning to add to the pile of endless screaming about how Robinhood traders are going to be the sole cause of the biggest bubble ever. Nothing new under the sun.... Read More

Posted on 16th Jun 2020

#LSS #signals

LongShortSignal.com's free and premium subscriptions include assets from a variety of classes, such as stocks, bonds, commodities, currencies (Forex) and even cryptocurrencies. So what trading platform should I use and what ticker should I be trading?

This will mainly depend on where you live. For those living in the United States, you will most likely have access to a normal trading account like Fidelity, TDAmeritrade, Charles Schwab and even the more recently popular Robinhood. All to varying degrees offer $0 trading commissions which greatly reduces our transaction costs.... Read More

Posted on 11th Jun 2020

#market views

Last Monday, the S&P 500 returned positive year-to-date which is quite remarkable following the Covid-19 pandemic and resultant liquidity induced 34% correction witnessed mid-March.

The Federal Reserve, and indeed other major central banks, unleashed unprecedented monetary stimulus to deal with this exodus of liquidity from risk assets.... Read More

Last Monday, the S&P 500 returned positive year-to-date which is quite remarkable following the Covid-19 pandemic and resultant liquidity induced 34% correction witnessed mid-March.

The Federal Reserve, and indeed other major central banks, unleashed unprecedented monetary stimulus to deal with this exodus of liquidity from risk assets.... Read More

Posted on 9th Jun 2020

#models

One of the best performing - if perhaps least exciting - models this year has been our US Treasury model which maintained its recommendation to be long US Treasury since December 2019. In fact, except for a quick trend break in December 2019 that lasted all of 17 days, the signal from our US Treasury model has pointed in this direction since November 2018, when the US 10 year yield peaked out at approximately 3.25%. What gives?... Read More

One of the best performing - if perhaps least exciting - models this year has been our US Treasury model which maintained its recommendation to be long US Treasury since December 2019. In fact, except for a quick trend break in December 2019 that lasted all of 17 days, the signal from our US Treasury model has pointed in this direction since November 2018, when the US 10 year yield peaked out at approximately 3.25%. What gives?... Read More

Posted on 7th Jun 2020

#investment process

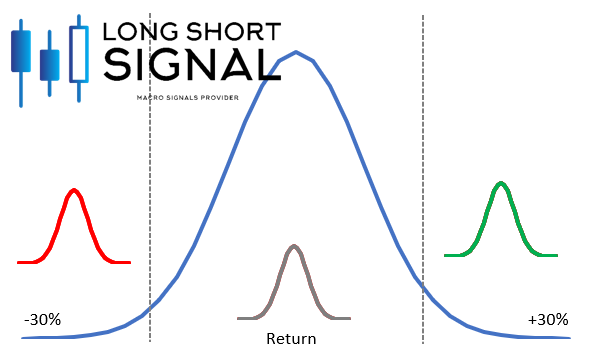

Traditional portfolio management on the buy-side often still centres around Modern Portfolio Theory, a half a century old (!) model which describes the idea that the expected return of a portfolio can be maximized for a given level of market risk and one combination of portfolio exposures provides the "optimal" portfolio. This theory treats historical returns as a continuum: 2008 (-38% return on stocks) and 2019 (+30% return on stocks) are opposite parts of the same return distribution. Instead, our investment process utilizes quantitative regime shifting models which have the underlying understanding that markets behave differently during good and bad times, and with a degree of statistical certainty, we can estimate what regime we are in today, aiding your investment decisions.... Read More

Traditional portfolio management on the buy-side often still centres around Modern Portfolio Theory, a half a century old (!) model which describes the idea that the expected return of a portfolio can be maximized for a given level of market risk and one combination of portfolio exposures provides the "optimal" portfolio. This theory treats historical returns as a continuum: 2008 (-38% return on stocks) and 2019 (+30% return on stocks) are opposite parts of the same return distribution. Instead, our investment process utilizes quantitative regime shifting models which have the underlying understanding that markets behave differently during good and bad times, and with a degree of statistical certainty, we can estimate what regime we are in today, aiding your investment decisions.... Read More

Posted on 31st May 2020

#monthly signals recap

LongShortSignal.com officially launched in early 2020. Our signals are updated daily, but on a regular basis, we also want to share with you our views on how the models have been performing and the signals they have been giving.... Read More