Posted on 11th Jun 2020 by the LSS team

Last Monday, the S&P 500 returned positive year-to-date which is quite remarkable following the Covid-19 pandemic and resultant liquidity induced 34% correction witnessed mid-March.

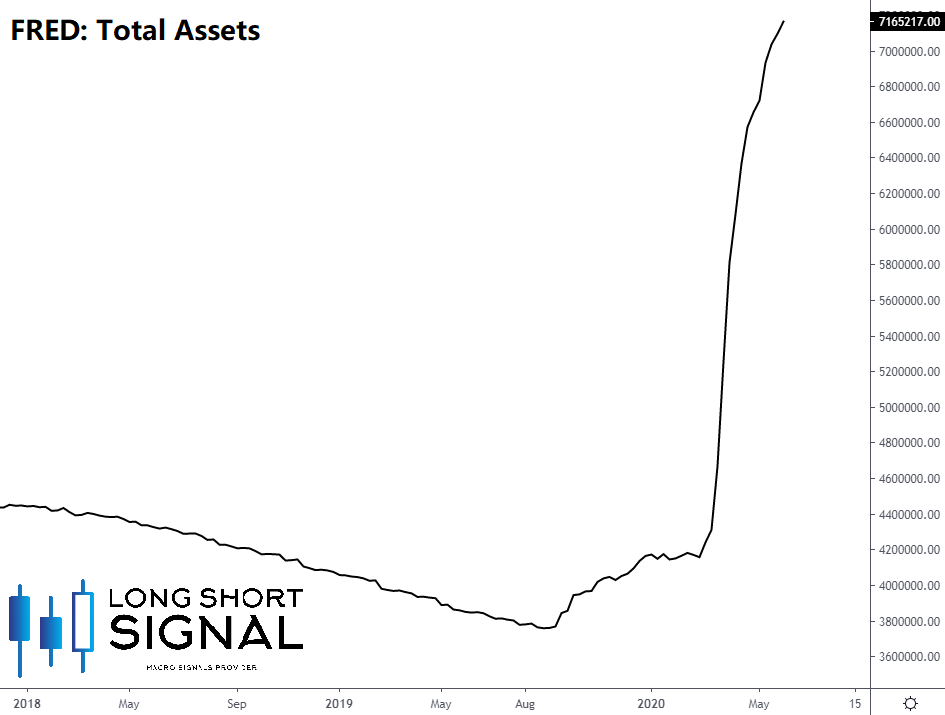

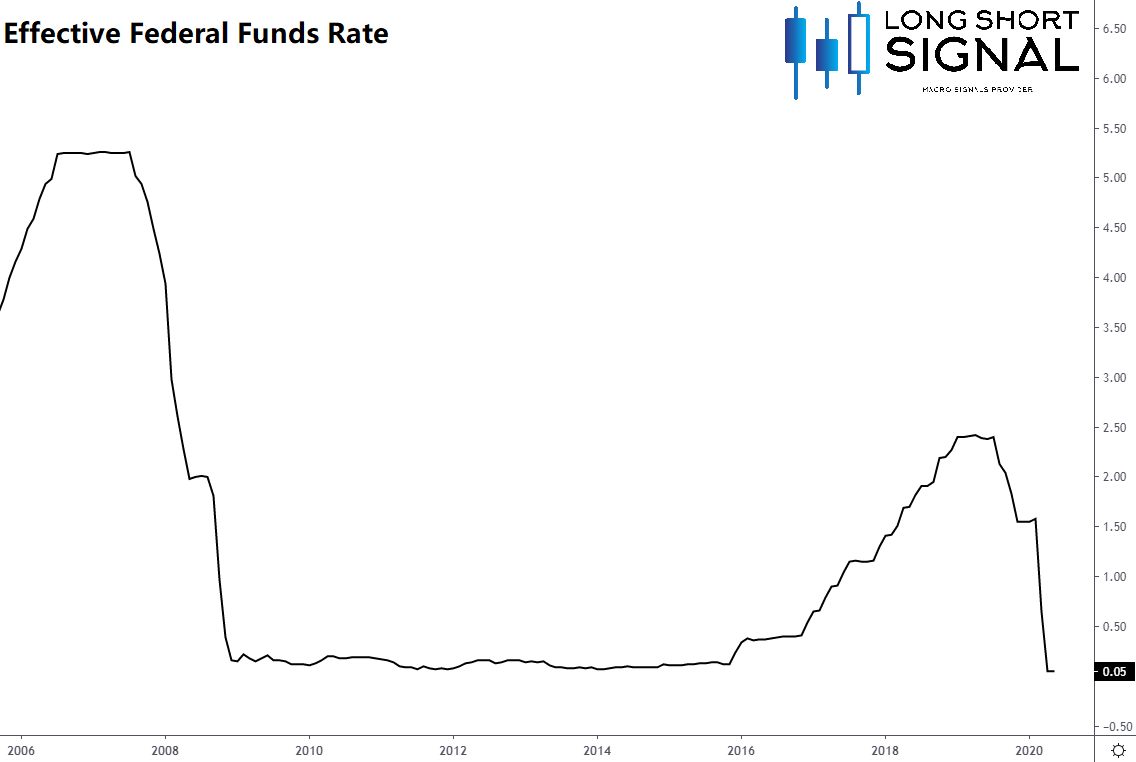

The Federal Reserve, and indeed other major central banks, unleashed unprecedented monetary stimulus to deal with this exodus of liquidity from risk assets. Just like a burst water main, the Fed’s main goal was to fix the ‘plumbing’ of the financial markets, by ‘flooding’ it with cheap credit, to… somewhat awkwardly continue the analogy.

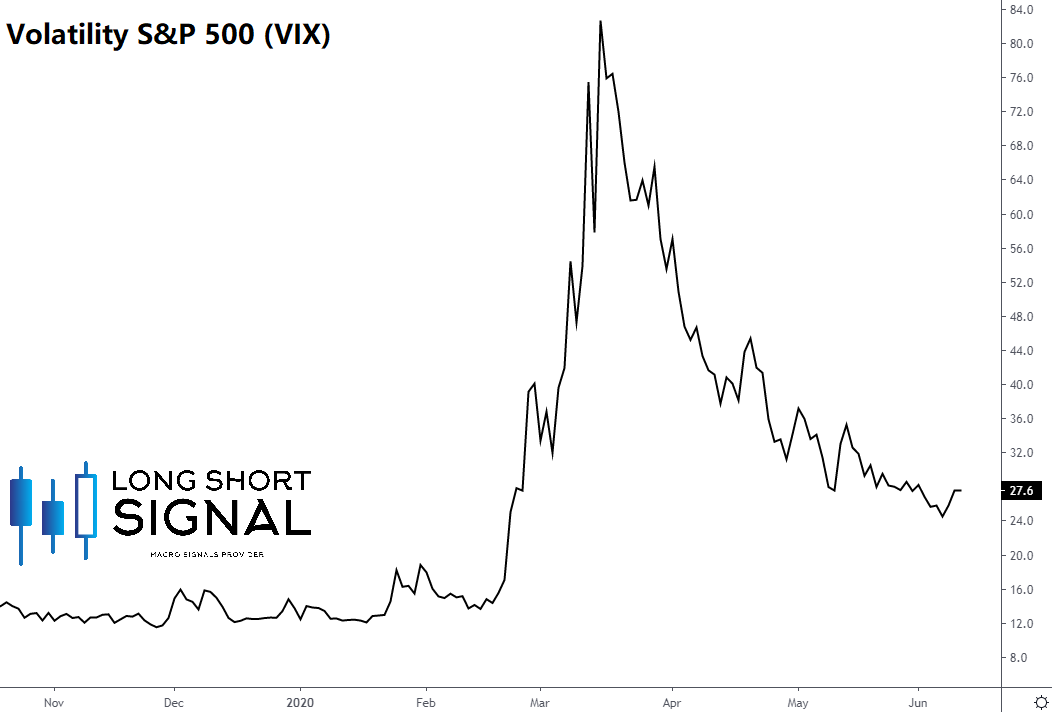

Investors read this as the Fed having “their back” and thus confidence and liquidity returned to asset markets. Extreme volatility across the equity, currency and bond markets likewise subsided.

Fed Chairman, Jay Powell, last night said: “We're not thinking about raising rates. We're not even thinking about thinking about raising rates." Even the “dot plot” which US policymakers use to predict future changes in monetary policy, do not show an increase in rates before 2022.

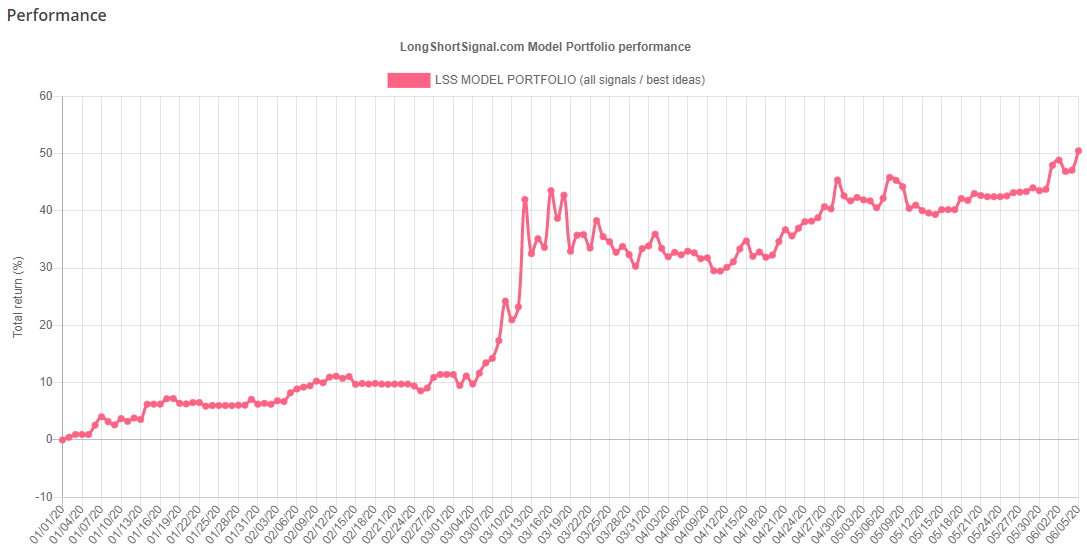

So, asset markets have been reflated and for those fortunate enough to have remained fully invested or “picked the bottom” have done well. However, and whilst this is the ‘shortest bear market in history’, it is still flat year-to-date.

Fortunately for LongShortSignal’s free and premium subscribers, with their access to our quantitative macro signals, not only have they outperformed the market with 50.49% year-to-date, but in risk-adjusted terms, our model portfolio’s max drawdown (peak to trough) is only 14.04%.

Should you be interested in learning about our proprietary models, please check out the Models section for more.

- Courtesy of LongShortSignal’s Quant Team