Posted on 18th Jul 2020 by the LSS team

Our premium signals have had a win rate of 71.1% in 2020, with the profitable signals resulting in average gains of no less than +34.6%, compared to losses of -4.6% on the unsuccesful ones. Our model portfolio has delivered a total return in 2020 of +67%, with positive returns in every single month including a +9.4% result in July.

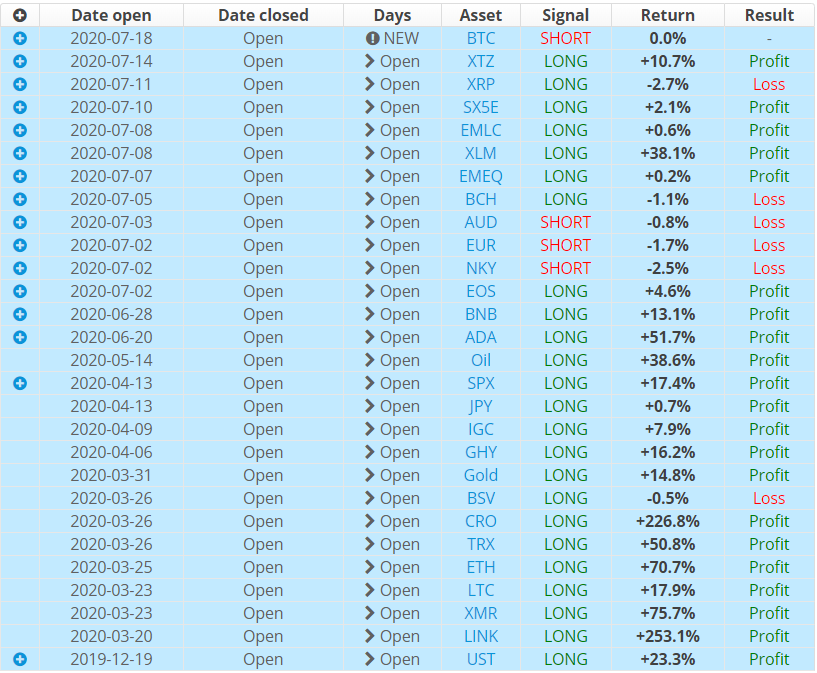

We currently have 28 open signals, with a clear LONG bias as 24 of them point in that direction. The average return on all signals has been +33%, which is mostly a result of the fact that our quantitative models have a tendency of letting the winners ride out, while losses tend to be quickly cut. The flipside of that is that in times of sideways trading like we have seen in Bitcoin recently, you get some minor losses either way as the models can have a hard time picking out the direction.

Some of the current highlights of our signals today are:

* A crypto portfolio positioned for altseason: as of today we have a short call on Bitcoin, and positive calls on nearly all altcoins. That includes the likes of Crypto.com coin which has returned +227% since the LONG call was made in March, but also ChainLink (+253%), Cardano (+52%) etcetera.

* Long calls on European, US and EM stocks with a short call on Japanese stocks. Look, we don't follow these markets up close besides what is spit out of our models, and it's apparent that the Nikkei signals has not worked yet (-2.5% return since being called short). However the model has been fairly stubborn and has left that call on for the better part of the month. It might be good to pay it some attention.

* Short euro and Aussie dollar vs long Japanese yen. What essentially amounts to a long US dollar call is combined with a long Japanese yen signal. Again these signals have not been succesful thus far, but both EUR and AUD have generally been linked to risk sentiment. Japanese yen calling a LONG (+0.7% so far) is just the cherry on top

* Long gold and US treasuries. These trades have obviously worked very well so far this year and the long treasuries position is officially the longest and most stubborn one across all of our signals. Like our currency signalling, these both point to continued risk aversion and flight to safe havens.

In our full model portfolio (which includes crypto), we have a somewhat conservative stance at the moment with a 15% long US treasury, 13% long gold, 10% long JPY, 10% short EUR and 17% short Bitcoin (offset by 5% long Cardano) position. At the same time we do have 20% long S&P500 and 9% long oil as well. In our traditional model portfolio we replace the crypto parts with long EM local currency bonds and EM equity.