Posted on 27th Jun 2020 by the LSS team

So far, 2020 has been nothing if not a wild ride for financial markets. The S&P500 started the year on a slow upwards grind and was up as much as 5% by February (which would have been a respectable result for the entire year if it had stayed there). It then started dumping to the bottom from 19th February onwards, eventually going as far down as -30%.

We all know what happened next as central banks stepped in to save the day one after the other. Today, it would appear to me that markets remain fragile as risk levels are elevated and concerns about things like global economic growth and the impact of COVID-19 but also geopolitics, trade friction, upcoming US elections etc. continue to weigh on sentiment.

No one can accurately predict what lies ahead, and even for the most visionary souls amongst us that do have an inkling, timing the changes will be difficult. Yet I think at a high level there are certain things you can do in your portfolio today to prepare yourself and your finances from financial pain. Some of these are non-conventional ideas for a non-conventional time.

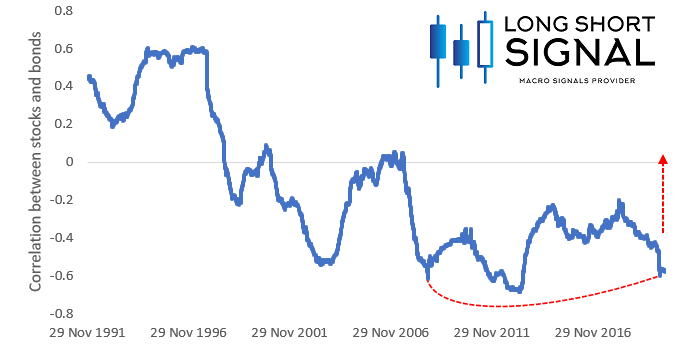

One of the core underlying ideas we work with is that diversification, as you used to know it (spreading your money between uncorrelated traditional assets to lower volatility, essentially), is dead and may actually have been an anomaly of the last few decades. Instead, a new type of diversification featuring modern assets and techniques, as well as higher liquidity and more active views on investments using a common sense approach is going to be increasingly needed. The world is changing before your eyes.

I stated this in one of our LSS Views pieces a week or so ago, but I think it is worth repeating. We have seen correlations spike to 1 in recent financial crises, and the same thing happened during the February/March 2020 sell-off. Risk assets now consistently behave like one and the same thing during these periods but a new development has been that even gold and fixed income joined the pack as markets lacked liquidity so investors dumped it to generate cash. We think bonds are headed back to how they behaved before the 1990s: correlating with risky assets.

With interest rates in the US now at ~50bps and the US possibly soon joining the negative rates group (inevitable in my opinion), we also think downside risk in being long-only fixed income is huge, while it yields next to nothing anymore. The sooner investors ditch investing in this asset class in favour of more assets with better prospects the better. And so, with that, we can declare diversification dead and start to think about how to actually deal with this paradigm shift.

There's a lot not to like in the world of financial markets today. We may be headed towards a solvency crisis and could start seeing defaults on high yield bonds, even if the Fed has for now backstopped any liquidity concerns. Stocks of old economy companies (think travel stocks, main street retail firms, and so on) may bounce up and down but seem inherently risky to me. Yet at the same time, there are things that should work extremely well in the new world we are all facing.

Precious metals and gold miners have done well, Amazon stock is up nearly 50% from the bottom, home decoration, gardening and F&B businesses that are able to successfully pivot to an enjoyable delivery "experience" could do well. Rather than avoiding risk altogether, we would advise a common sense approach: we are now in a different world of deliveries, remote working, potential economic concerns, and this is very likely to be the way of the future. We are at a pivotal time where picking the right investments to position for this theme could pay off handsomely down the line. We, therefore, suggest to invest in this theme knowing full well that while things may sell off during the next crisis, but that post that they should bounce back even stronger.

What you want to make 100% sure of is that once markets sell off, you can ride out the storm without needing to generate cash to pay the bills and sell assets at fire-sale prices. Strongly related to not having the urge to sell near the bottom is that you need to maintain appropriate position sizes. If 100% of your investments are in a few tech companies that you know will do well over the medium to longer-term and that probably even sell off less than the market, you will still be staring at your portfolio rather nervously during peak market pain. By picking investment themes that will keep working you are likely to generate outsized returns over the longer haul, so why not choose to allocate smaller portions of your portfolio to it rather than the whole thing? We prefer a Barbell approach of having pockets of assets that can generate outsized returns offsetting a larger portion of more conservative assets.

There's a lot of debate about whether the USD should strengthen or weaken, and the investment thesis for both sides of that story seems compelling to us. Having some non-USD exposure (whether in Europe, Japan or other emerging markets) makes sense. What's also clear to us is that the US share of global GDP is declining as a number of countries including India, Brazil, Indonesia and China line up to grab growing parts of the economic pie. Emerging markets are volatile beasts so you don't want to overexpose yourself to them, but avoiding them altogether is a near surefire way to underperform over the next decades.

Bitcoin and other cryptocurrencies are a nascent asset class that is still tiny in size, with a market cap less than 3% of Gold at time of writing. There is always the obligatory mention of "it could go x100 or it could go to zero" but while true for "altcoins", we do not really buy into that for Bitcoin itself. Bitcoin has already proven itself and has been a remarkable store of value over the last years. It isn't going anywhere and as investor interest in a form of hard money that is not easily manipulated and debased by central banks grows, it is pretty sure to do very well.

What's even better, elsewhere in the cryptocurrency space we see projects like Tezos, Algorand and Cardano pursuing innovation that is like an exponential multiplication of the themes of innovation, cryptocurrency and uncertainty amidst a changing economy... we see huge return potential there and think allocating even a sliver of your portfolio here will pay off handsomely.

Across financial markets, we think many asset classes are likely to show far lower return potential over the next say 5 to 10 years than what they have realized over the last decades. Whether it is in bonds (nearly no return potential left), or even commodities, real estate or stocks, targeting the 7-8% returns that pension funds, for instance, seem to be hoping for seems mission impossible to me.

In addition to lower upside potential, risk to the downside is increasing. Using our investment signals (or a similar approach) allows you to be selective in taking exposure, and benefiting as much from an asset that trends down or is moving rangebound as from one that is going up 10% a year.